News on Interest Rates in the current unstable economy, it is more crucial than ever to stay informed on interest rate news. Interest rate fluctuations can have a big effect on your financial health, regardless of whether you are a homeowner, investor, or just someone saving money. The U.S. Federal Reserve and other central banks across the world have been adjusting in recent months to manage inflation and economic expansion. Mortgage rates, loan interest rates, and even savings account returns are all directly impacted by these choices.

Consumers and financial markets are closely monitoring interest rate changes as 2025 progresses. Making wise financial decisions requires an understanding of these developments and how they could affect borrowing, investing, and saving. This essay will dissect the most recent interest rate news, examine its implications for various financial sectors, and offer professional predictions for the future.

The Significance of News on interest rates

The economy is fundamentally shaped by News on interest rates. They have an impact on everything from credit card debt and home loans to inflation control and investment returns. Interest rate increases make borrowing more costly, which makes it more difficult for people and businesses to finance investments or purchases. However, since banks provide better returns on deposits, savers gain from rising rates.

Lower News on interest rates make loans more accessible, which promotes borrowing and spending and may contribute to economic expansion. Lower rates, however, also translate into lower returns for fixed deposits and savings accounts. Central banks carefully modify News on interest rates in order to strike a balance between promoting spending and preserving financial stability. People may plan for changes in their finances and make the best choices for their loans, savings, and investments by being aware of the most recent interest rate news.

Current Interest Rate Shifts

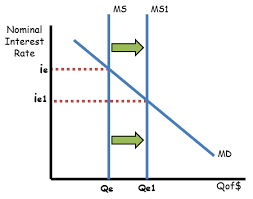

As central banks respond to worries about inflation and the state of the world economy, News on News on interest rateshas dominated financial headlines in recent months. In its most recent effort to stabilize the economy, the U.S. Federal Reserve has announced raising News on interest rates by 0.25% in an effort to reduce inflation. Higher mortgage rates as a result of this increase have increased the cost of homeownership for both first-time buyers and those wishing to renew their loans.

The European Central Bank (ECB), meanwhile, has decided to ensure economic stability throughout the Eurozone by keeping News on interest rates steady. Due to weak economic growth, the Bank of England in the UK is contemplating a potential rate drop, which would benefit borrowers but reduce returns for savers. These worldwide interest rate shifts have an effect on international trade and investment markets in addition to national economies.

Although the Federal Reserve’s rate increases are intended to curb inflation, financial analysts point out that they also raise borrowing costs, which may impede consumer spending and company growth. Higher monthly loan and mortgage payments are the result for many customers, which emphasizes how crucial it is to keep up with News on News on interest ratesand adjust financial plans accordingly.

The Impact of News on interest rates on You

Depending on whether they are borrowing, investing, or saving, consumers are impacted by changes in News on interest rates in different ways. Rising News on interest rates result in higher mortgage payments for both buyers and homeowners. In the short term, those with fixed-rate mortgages are unaffected, but those with adjustable-rate mortgages can notice a large increase in their payments. Slower real estate activity could result from this change, which might also deter prospective purchasers from joining the property market.

Interest rate changes have an impact on bond yields, stock market performance, and overall investment strategies for investors. Companies’ borrowing costs go up as News on interest rates rise, which could lower corporate profits and impede the expansion of the stock market. Since News on interest rates and bond prices typically move in opposing directions, rising News on interest rates may cause bond values to decline. Because rising borrowing rates lower property demand and profitability, real estate investors also face difficulties.

Increasing News on interest rates make it more costly for regular people to handle credit card debt. People with outstanding balances may see a rise in their debt payments because many credit card issuers base their interest rate adjustments on central bank policy. On the plus side, people that emphasize saving benefit from the higher returns that savings accounts and fixed deposits typically provide when News on interest rates rise. Consumers can make well-informed decisions about their financial objectives, such as paying off high-interest debt or utilizing better savings opportunities, by keeping up with interest rate news.

Interest Rate Forecasts by Experts

Regarding the likely course of News on News on interest ratesin 2025, financial experts are still at odds. According to some economists, as central banks work to contain inflation, News on interest rates will keep rising throughout the year. The Federal Reserve has hinted that additional rate increases would be required to preserve economic stability, which might result in ongoing increases in borrowing costs for both firms and consumers.

However, other analysts think that later in the year, interest rate decreases may result from a slowdown in economic development. Central banks may refocus their efforts on promoting growth by lowering News on interest rates if inflation stabilizes and economic activity declines. Borrowers would benefit from this situation, but investors and savers who depend on fixed-income assets would see a decline in returns.

Interest rates on loans and mortgages are predicted to stay high for at least the first half of 2025, with possible changes later based on the state of the economy. The Federal Reserve and Bloomberg market analysts advise people to keep a careful eye on News on interest rates and modify their financial plans as necessary.

How to Handle Money When Interest Rates Change

It is crucial to implement financial plans that guard against growing expenses while optimizing possible opportunities in light of the continuous changes in interest rates.

Borrowers should prioritize paying off high-interest debt since variable-rate loans and credit card balances become more costly when interest rates rise. To lock in steady monthly payments before more rate increases take place, people with adjustable-rate mortgages can think about refinancing to a fixed-rate mortgage.

Rising interest rates offer savers the chance to profit from fixed deposits and high-yield savings accounts. In order to give depositors better returns, financial institutions frequently raise the interest rates on their savings products when the central bank rises rates. Long-term savings plans and fixed deposits can be useful instruments for people trying to lock down advantageous interest rates ahead of future reductions.

Diversifying investment portfolios can assist investors in reducing the risks brought on by changes in interest rates. Bonds and other fixed-income assets can offer security during uncertain times, even when rate fluctuations may exacerbate stock market volatility. Investors can make educated decisions to safeguard and increase their wealth by closely monitoring interest rate news.

Conclusions

Anyone hoping to make wise financial decisions in 2025 must stay up to date on interest rate news. Knowing how interest rates impact you is essential to financial success, regardless of whether you are a consumer managing credit and savings, an investor modifying your portfolio, or a homeowner contemplating a mortgage.

The economy is still changing, and central banks will probably change interest rates in response to market stability, inflation, and economic growth. People may better manage these changes and make wise decisions to protect their financial future by remaining proactive and educated.

Check out our latest updates on us news updates to understand the bigger picture of gun violence.

For official reports and safety guidelines, amp visit the website.

Examining resources like Federal Reserve Reports and professional financial analysis can offer insightful information to anyone curious about how to best manage their money in response to changes in the economy. Make the most of your financial chances in 2025, prepare sensibly, and stay informed.