In the context of international finance, currency substitution is becoming more and more common. Many nations and companies are using foreign currencies to stabilize their economies as economic uncertainty increases. This blog will examine current advancements, the future of this financial trend, and a detailed explanation of the currency substitution concept.

Currency Substitution: What Is It?

When a nation or region begins to use a foreign currency, either entirely or in part, in place of its own, this is known as currency substitution. This frequently occurs in economies that are dealing with unstable economies, high inflation, or currency devaluation. Although the US dollar is the most often used substitute currency, other powerful currencies like the euro and yuan are also utilized. It is easier to understand currency substitution’s effects on global economies when it is illustrated using examples from everyday life.

Partial and full currency replacement are the two varieties. When foreign money is used in conjunction with local currency for certain transactions, like international trade and savings, this is known as partial currency replacement. When the native currency is fully replaced by a foreign currency, this is referred to as dollarization or full currency replacement.

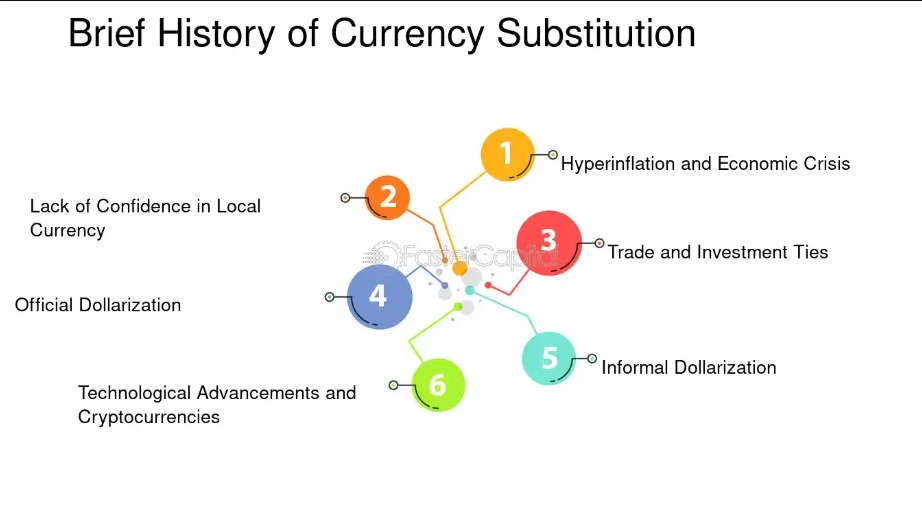

An explanation of the causes of currency substitution

In various economies, currency substitution is driven by a number of causes. Gaining insight into these factors helps explain why countries and companies adopt foreign currencies.

Currency devaluation and hyperinflation

People prefer to hold stable foreign currencies when hyperinflation causes a country’s currency to depreciate quickly. Examples of countries where inflation has caused widespread currency replacement are Argentina and Venezuela.

Economic and Political Unrest

Currency substitution is common in nations experiencing political unrest or economic volatility as their population looks for financial stability. To preserve buying power and economic stability in these situations, there is a greater reliance on foreign currencies.

Have faith in a more robust economy

People switch to the currency of a more stable and economically strong country when they lose faith in their own. For savings and major transactions, many emerging nations use the US dollar or the euro.

Foreign Investment and International Trade

Businesses and governments in many developing nations favor using foreign currencies for foreign direct investment (FDI) and international trade. This lessens the dangers brought on by local currency fluctuations.

An explanation of recent developments in currency substitution

- Growing Dollarization in Developing Economies

The US dollar has become more and more important for trade, savings, and transactions in many emerging economies, including Zimbabwe and Argentina. The desire for a trustworthy store of value and the volatility of their local currencies are the causes of this change.

- Using Cryptocurrency as a substitute

Stablecoins and Bitcoin are examples of digital currencies that are gaining popularity as money substitutes. Cryptocurrency usage is booming in nations with unstable currencies as a way to protect value and ease cross-border transactions. This pattern demonstrates a contemporary method of currency replacement that can be attributed to the growth of decentralized finance.

- Currency swaps and central bank policies

To combat an over-reliance on foreign currencies, central banks around the world are enacting new regulations. To stabilize their economy, some are strengthening their foreign exchange reserves, while others are entering into currency swap agreements.

- The Yuan’s Place in International Markets

China has been advocating for the yuan, its currency, to be used more widely abroad. The yuan is currently being considered for trade settlements by several nations, which will further diversify the tendencies of currency substitution.

An explanation of the effects of currency substitution

Currency substitution has a number of economic ramifications that governments and corporations need to take into account, even if it can offer stability.

Benefits:

Lower Transaction Costs: Using a widely accepted foreign currency minimizes the need for currency conversions in international trade.

Reduction in Exchange Rate Risks: By keeping stronger foreign currencies, businesses and people can prevent local currency depreciation.

Enhanced Financial Stability: Using foreign currencies can act as a buffer against hyperinflation in countries that are already extremely unstable.

Better Access to Global Markets: Companies that deal in stable foreign currencies are better able to access global investment and trade possibilities.

Negative Effects: Loss of Monetary Policy Control: When foreign currency takes over an economy, governments are unable to control the money supply and interest rates.

Dependency on Foreign Economic Conditions: The policies and economic circumstances of the issuing country have an impact on a country’s use of a foreign currency.

Impact on Banking Systems: When the usage of foreign currencies becomes prevalent, local banks may encounter difficulties managing their liquidity.

Exchange Rate Volatility Risk: Local economies may be impacted by volatility in even stable foreign currencies.

An explanation of the currency substitution outlook for the future

1. Digital Currencies’ Function

Central banks are investigating digital currencies (CBDCs) as a way to lessen currency substitution in light of blockchain technological improvements. Digital versions of national currencies are being actively developed by nations such as the European Union and China. The conventional picture of currency replacement, as outlined in global economic plans, may change with the development of digital finance.

2. Effect on Regional Markets

A nation’s monetary sovereignty may be weakened by currency substitution, even though it can offer temporary stability. To lessen reliance on foreign currencies, governments will need to enact strict banking regulations. Examining how currency substitution affects regional economies reveals the compromises between autonomy and stability.

3. International Economic and Trade Policies

International trade agreements and economic policies will change as more economies embrace foreign currencies. Reduced exchange rate risks may be advantageous to businesses, but governments must carefully control monetary policy to maintain economic growth. Explained in terms of its effects on financial markets, currency substitution will have an impact on international trade in the future.

4. Regional Currencies’ Expanding Role

To lessen their reliance on the world’s reserve currencies, certain regions are attempting to fortify their own currencies. One example of an initiative to encourage the use of regional currencies rather than depending on international ones is the African Continental Free Trade Area (AfCFTA).

Techniques for Handling Currency Substitution

To lessen the negative impacts of currency substitution and recover authority over their monetary policies, governments and financial institutions can take certain actions.

Increasing the value of local currency

putting into practice sensible economic principles to stable the local currency and manage inflation.

To preserve currency value, foreign exchange reserves should be increased.

promoting the use of indigenous currency by nearby companies.

Encouraging Trust in Home Banking Systems

providing incentives to promote the use of local money.

preserving bank stability in order to avoid an over-reliance on foreign exchange deposits.

restricting capital flight by enforcing stringent laws on foreign exchange transactions.

Examining Alternatives in Digital Finance

To compete with foreign currencies, central bank digital currencies, or CBDCs, are being developed.

utilizing digital payment methods to improve financial inclusion.

putting laws into place to promote bitcoin use that is safe for the sake of financial stability.

Conclusion

One important aspect of the contemporary financial system is currency substitution. For many economies, it provides stability, but it also presents monetary control issues. The future of currency replacement as outlined by new technology and legislation will keep changing in light of current advancements in digital finance and worldwide economic trends. It is crucial for investors, companies, and legislators to monitor these developments. Navigating this intricate financial environment is made easier for people and organizations when they comprehend how currency replacement is explained in different settings.

Check out our latest updates on us news updates to understand the bigger picture of gun violence.

For official reports and safety guidelines, money.usnews visit the website.

To maintain monetary sovereignty while leveraging foreign currencies for stability, governments, corporations, and financial institutions must cooperate. Through fostering financial literacy, fortifying economic regulations, and implementing cutting-edge digital finance solutions, nations can reduce the dangers of excessive currency substitution and establish a more robust economic landscape.